Solar + Storage and the Federal Tax Credit

This month, House representative Mike Doyle introduced a bill to expand the federal tax credit for solar systems with energy storage. Under the new bill, all energy storage products would become eligible to be claimed under the tax credit.

The federal tax credit is a major incentive for going solar. Under the program, 30% of your project costs can be claimed as a credit to reduce your tax liability when you file your federal taxes.

But right now, the cost of energy storage can’t always be claimed under the credit. That would change with this new bill, which would remove restrictions and make all storage products eligible to get full value out of the credit.

As solar batteries become more affordable, energy storage adoption is on the rise. Sunrun reports that 20% of new solar systems installed in California in 2018 included an energy storage solution. If this legislation passes, it will accelerate solar+storage adoption by simplifying the process of claiming the credit.

Why Invest in Solar + Storage?

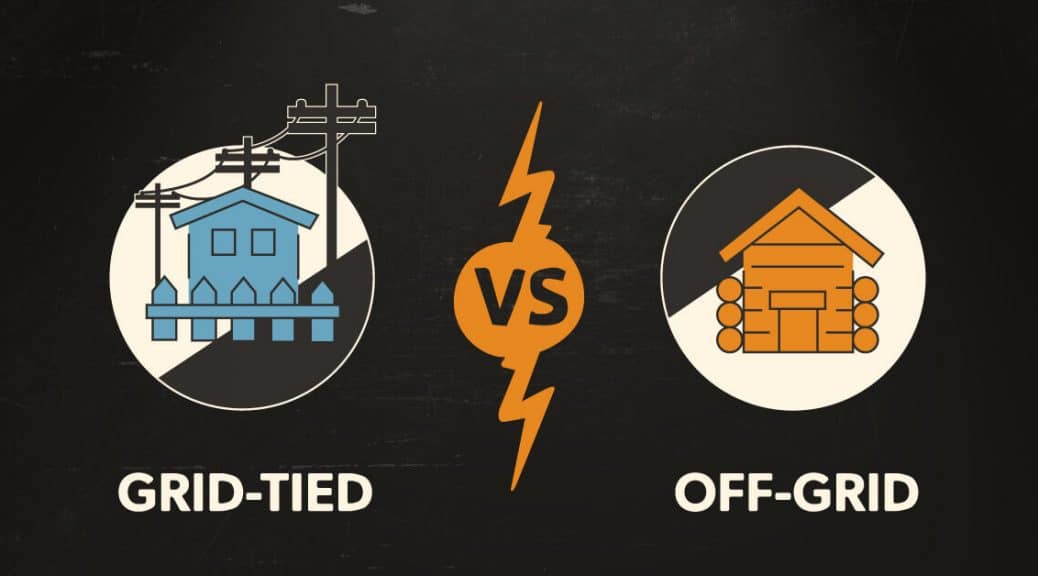

Grid-tie systems connect to the public utility grid. When your panels generate energy, the electricity feeds into the utility grid. The utility credits your account for the electricity you contribute, which you can draw upon during low sunlight periods (at night, during bad weather, etc.).

Batteries aren’t necessary for grid-tie systems, but they add versatility to your application.

The main appeal is the ability to store energy and use it during peak periods. Your panels generate energy during the day when the sun is out, but most utilities charge much higher rates during peak usage periods (around 5-10pm, when people come home from work and school). Batteries allow you to store energy generated during the day for use during the evening, bypassing peak usage rates and saving you money.

Batteries also offer emergency backup when the power grid goes down. Since the solar array is tied to the utility grid, it needs to stop sending power into the grid during outages. This anti-islanding feature protects utility workers who are making repairs to the grid. With an energy storage system, your batteries will take over during outages, acting as a backup power source when the grid goes down.

How Solar + Storage Works Under the Current Tax Credit Law

Under the current law, energy storage solutions can only be claimed under the tax credit if they are charged by a renewable energy source (like solar). If you charge the batteries with grid power, that’s not a use case that is eligible for the incentive.

The amount you can claim is proportional to how often the battery is recharged from a renewable source. If you are charging your batteries from solar 90% of the time, you can claim 90% of the cost of the battery under the credit.

For example, here’s the math for a $5,000 battery bank that receives 90% of its charge from solar:

$5,000 x 0.9 (90% solar charge rate) x 0.3 (30% tax credit) = $1,350 tax credit

Furthermore, if you spend more than 25% of your time charging batteries from the grid, you can’t claim your batteries under credit at all. You must hit a minimum of 75% PV charging rate to be eligible:

- Battery charged by PV under 75% of the time: not eligible to claim tax credit

- Battery charged by PV 75-99% of the time: claim a portion of the tax credit equal to PV charging rate

- Battery charged by PV 100% of the time: claim the full tax credit

Take a look at this 1-page fact-sheet from NREL for more info.

As you can see, not all energy storage products can be claimed under the credit, and the restrictions require the owner to track the charging source to accurately report their usage to the IRS.

Those restrictions would be lifted if the new bill proposed this month passes into law.

Proposed Changes Under the New Solar + Storage Tax Credit Bill

The latest bill introduced in the House seeks to remove the complicated limitations of the current incentives. Under the new bill, the full cost of all solar storage products would be eligible for the tax credit, just like all other system components.

There would be no partial credit or minimum charge restrictions. If you buy an energy storage system, it would be eligible for the full tax credit—period.

The change would make energy storage more appealing to the public, regardless of application, and add more momentum behind the adoption of storage-ready systems. That move is supported by solar enthusiasts and utility providers alike, as energy storage systems help smooth the demand curve, reduce the burden on the grid and prevent brownouts.

Interested in going solar with an energy storage solution? Take a look at our solar+storage packages and grab the free battery guide linked below for more info. If you have any questions, you can always call us at 1-800-472-1142 for a free consultation with a solar designer.