Form 5695 Filing Instructions

This article provides quick step-by-step instructions to help you file IRS Form 5695 and claim your renewable energy credits. We’ve provided sample images of the tax forms to help you follow along.

The federal tax

This article provides a simple step-by-step walkthrough that will explain how to file your taxes to claim the Federal Tax Credit for investing in renewable energy.

Before we start, you’ll need to gather your receipts for any project costs. You can claim the cost of the system as well as any associated installation costs (materials, hired labor, permitting fees, etc.).

Step 1: Download Tax Forms

You’ll need four forms to file for the credit, which can be downloaded from the IRS website.

Form 5695

This is the Residential Energy Credits Form. We’ll be paying the most attention to this one.

Form i5695

This is an information form about the 5695 that contains a worksheet we’ll be filling out.

Form 1040

This is the Individual Income Tax Return form that most people use to file their taxes.

Form 1040 – Schedule 3

This form covers tax credits, including the renewable energy credits. Add your Form 5695 results here to claim the credit.

Download 1040 – Schedule 3 here »

Step 2: Add Up Project Costs

First we need to know the total amount you paid to install your solar system. This includes the cost of components as well as any associated installation costs.

Gather your receipts and total any money you spent on the following:

- Solar components (panels, racking, charge controller, inverter, wire, etc.)

- Shipping costs

- Solar consulting fees

- Professional installer fees

- Electrician fees

- Engineer fees

- Tools purchased or rented for PV installation

- Equipment purchased or rented (scaffolding, man-lift, auger, etc.)

- Wiring Screws, bolts, nails, etc.

- Permitting fees

- Other associated costs

Keep note of this total so that you can transfer it over to your tax forms.

Step 3: Start Form 1040

Begin by filling out Form 1040. This is your individual tax return. It’s a good idea to do this first since you will be referencing Line 11 (your total tax liability) later in this process.

Once you complete this form, switch over to Form 5695 to start calculating your residential energy credits.

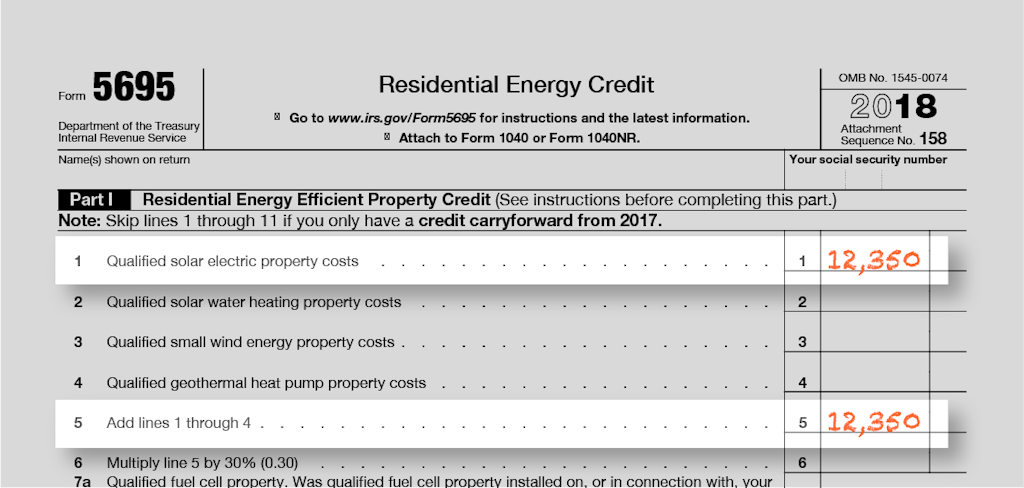

Step 4: Start Form 5695

Form 5695 focuses on renewable energy credits.

Line 1: Enter the total amount you spent on your solar project, which you calculated in Step 2. We’re using $12,350 as an example, but be sure to enter your own total.

Lines 2-4: In this example, we’ll assume you didn’t invest in another form of renewable energy during the tax year. If you also invested in a solar water heater, wind power, or a geothermal heat pump, add those totals here.

Line 5: Total lines 1-4 and add them here.

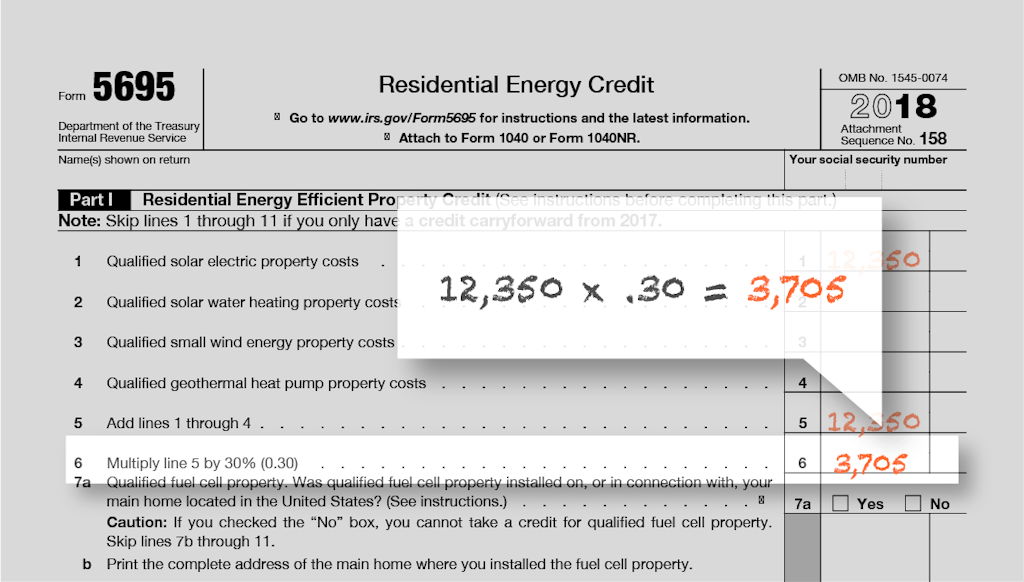

Line 6: Multiply the Line 5 total by 0.3. This calculates 30% of your project costs, the amount you can claim under the credit. Enter the result here.

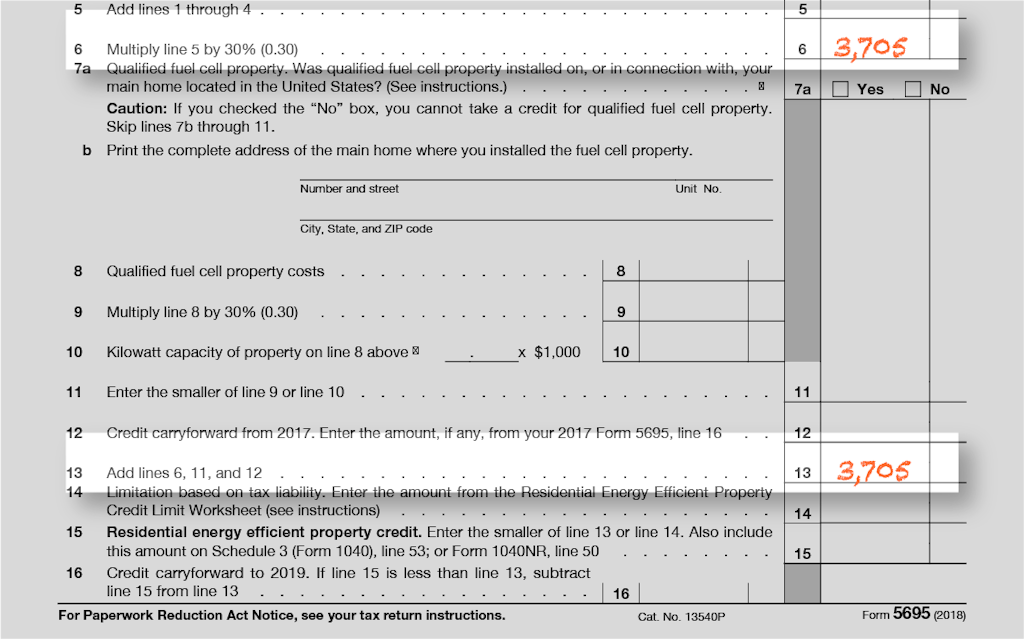

Line 7: If solar was your only renewable energy purchase, check “No.” If you bought fuel cells, check “Yes.”

Lines 8-11: Skip these unless you purchased fuel cells during the tax year.

Line 12: If you claimed the solar tax credit last year and are rolling over a portion of that credit to this year’s taxes, enter the remaining value of the credit here. Otherwise, skip this step.

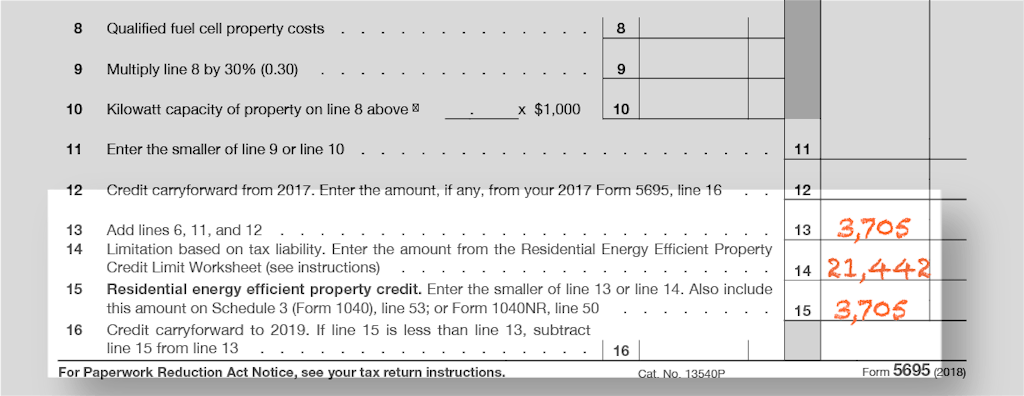

Line 13: Add the values from lines 6, 11 and 12. Enter the total here.

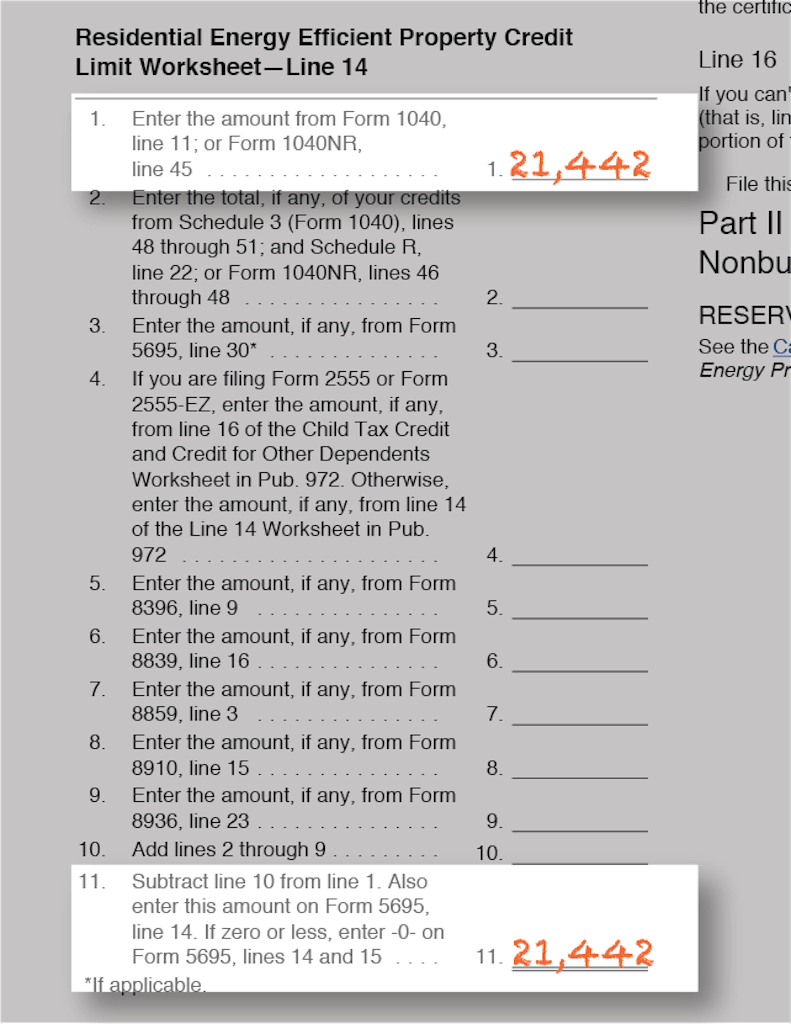

Step 5: Fill Out Form i5695 Worksheet

Form i5695 contains instructions on how to fill out Form 5695. We need to complete the worksheet on page 3, then transfer that information over to Form 5695.

Line 1: Enter the total taxes you owe. This is located on Line 11 of your Form 1040. We’ve entered $21,442 as an example of what someone making $100k a year might owe. Again, enter your own results here.

Lines 2-9: Enter any other tax credits you will claim. For simplicity, we’ll assume there are no other credits.

Line 10: Add up lines 2-9 and enter the total here.

Line 11: Subtract Line 10 from Line 1. The result is the total value of the credits awarded to you. Enter it here.

Step 6: Complete Form 5695

If your credit is higher than your total tax liability, the remainder of the credit can be rolled over and applied to a future tax return.

Now that we’ve finished the worksheet, jump back to Form 5695.

Line 14: Enter the value from Line 11 of the i5695 worksheet you completed in the previous step.

Line 15: Check Lines 13 and 14 and enter the lower of the two numbers on Line 15. This ensures your credit doesn’t exceed your tax liability.

Line 16: If Line 15 is less than Line 13, subtract Line 15 from Line 13 and enter the value here. This is the amount of “leftover” credit that can be rolled over to a future return. This is not common.

We’re done calculating your renewable energy credits! Now we just need to add it to your individual tax return.

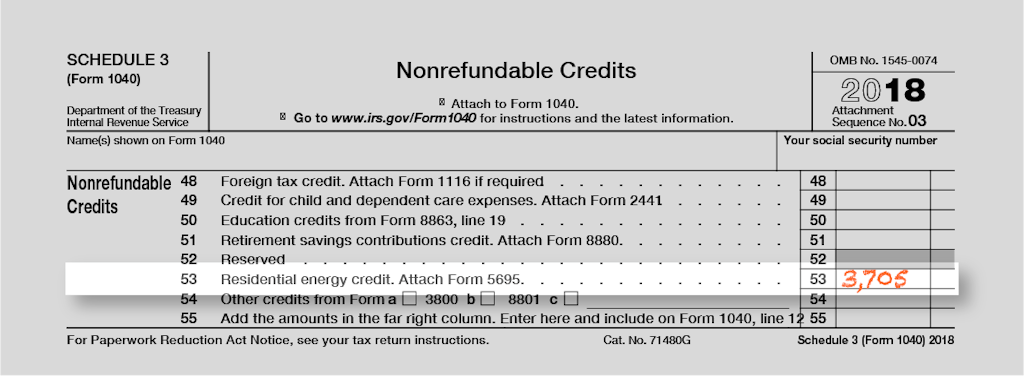

Step 7: Apply Form 5695 Results to Form 1040 – Schedule 3

Take the amount from Line 15 of Form 5695 and enter it on Line 53 of Form 1040 – Schedule 3.

Attach Form 5695 and Schedule 3 to your Form 1040 when you file. (No need to include the Form i5695 worksheet.)

You’re done! Kick back and bask in your reward for investing in renewable energy.

If you have any questions about how the Federal Tax Credit works, or simply want to explore the possibility of going solar, give us a call at 1-800-472-1142. You can also grab our free Federal Tax Credit guide for more info.

Disclaimer: This guide is offered as basic instruction only and is not meant as professional tax preparation advice. For specific tax-related questions or issues, we recommend consulting a certified tax preparation specialist or CPA.