Federal Solar Tax Credit – August 2022 Update

When you install a solar system in 2022, 30% of your total project costs (including equipment, permitting and installation) can be claimed as a credit on your federal tax return.

If you spend $10,000 on your system, you owe $3,000 less in taxes the following year. To claim the credit, your system must be fully installed. Solar systems take weeks to design, ship and install – so now is the time to start if you want to meet the deadline.

What Is the Solar Panel Federal Tax Credit?

First, let’s take a short walk down memory lane. The Solar Investment Tax Credit (commonly called the ITC) was first offered via the Energy Policy Act of 2005. Thanks to its popularity and its contribution toward renewable energy goals, the ITC has been extended multiple times. While it was originally set to expire in 2007, the current federal solar tax credit extension is set to expire in 2032. Homeowners can use the federal tax credit for battery storage, installing new systems, and more.

Alright, now how does the solar tax credit work? If you want a basic overview of solar incentives without wading through the tax jargon, you’re in the right place.

The bottom line is this: When you install a solar power system, the federal government rewards you with a 30% tax credit for investing in solar energy. In short, 30% of your total project costs (including equipment, permitting, and installation) can be claimed as a credit on your federal tax return for that year.

A quick but necessary disclaimer: we’re solar experts, not tax accountants! We do our best to give accurate advice, but please check with a professional to be sure you’re eligible to claim the credit.

A tax credit is a dollar-for-dollar reduction of the income tax you owe. $1 credit = $1 less you pay in taxes. It’s that simple. If you spend $10,000 on your system, you owe $3,000 less in taxes the following year.

It’s important to note that a credit is different than a refund because you have to owe taxes to claim the incentive. But since most people owe taxes, most people end up being eligible for the Federal Solar Tax Credit.

How Does the Solar Tax Credit Work and How Much Will I Save?

Right now, the Solar Investment Tax Credit (ITC) is worth 30% of your total system cost. This includes the value of parts and contractor fees for the installation.

As mentioned before, if it costs $10,000 to buy and install your system, you would be owed a $3,000 credit.

You are only allowed to claim the credit if you own your system. This is why we’re strongly opposed to solar leasing if you can avoid it. If another company leases you the system, they still own the equipment, so they get to claim the incentives.

You’ll still get the benefits of cheap, renewable energy if you lease. But missing out on the tax credit is a huge blow to getting a positive ROI from your system.

It makes more sense to take advantage of solar financing instead. You’re still on the hook for a loan, but you retain rights to the incentives that help make solar such a sound investment.

Am I Eligible to Claim the Federal Solar Tax Credit?

Yes, you probably are!

If you purchased a solar system before the end of the year, and owe federal taxes in the U.S., you are eligible for the tax credit.

An eligible solar energy system also must have been purchased after Jan 1, 2006 (so if you’re buying now, you’re fine!) and before the end of the most recent tax period in order to claim the credit on your tax return.

If your solar panel system is purchased:

If you meet all these criteria, you’re eligible to claim the Federal Solar Tax Credit when you file.

How do I claim the Solar Panel Tax Credit to Claim My Rebate?

So let’s get to the good stuff. What do you need to do to actually get your hands on this money and reduce the total cost?

Our first bit of advice is to keep all your receipts from the start of your solar installation project. Like any tax incentive, the Federal Solar Tax Credit requires a paper trail. The more you spend on your project, the larger your credit – so make sure to keep track of everything!

Here are some of the expenses that you are allowed to claim:

- Solar equipment

- Freight shipping costs

- Solar consulting fees

- Professional installation costs

- Electrician fees

- Engineer fees

- Tools bought or rented

- Wiring, screws, bolts, nails, etc.

- Equipment purchased or rented (scaffolding or a man-lift, for example)

- Permitting fees

- Permitting service costs

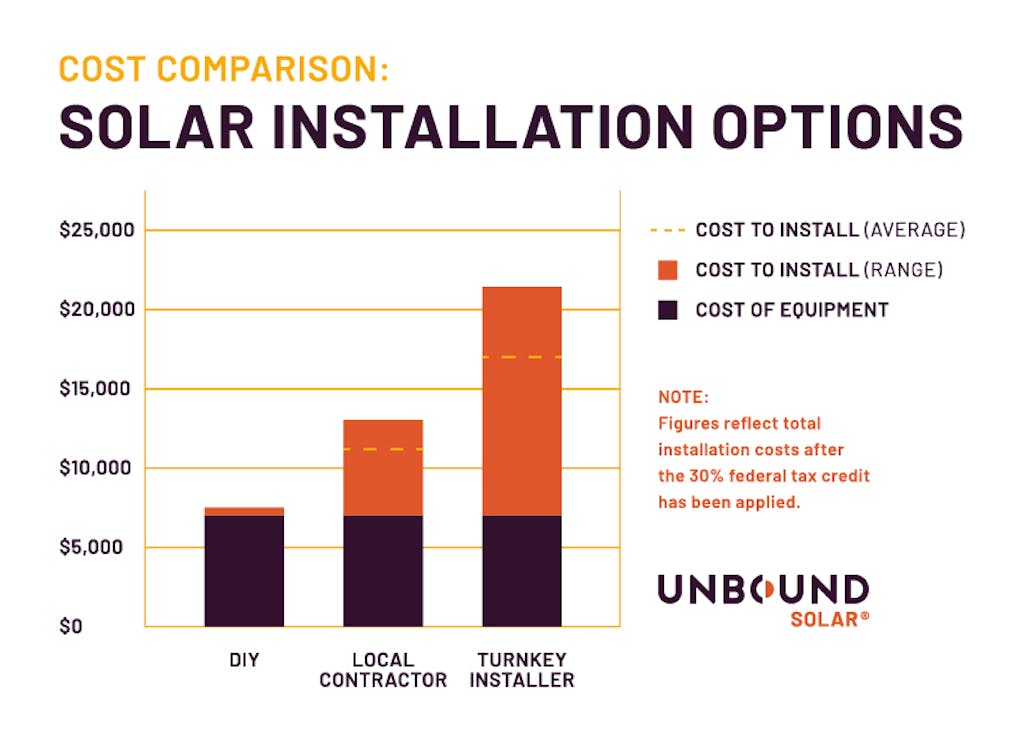

Costs will vary depending on the approach you take to installation. The good news is that hiring a contractor is an expense that can be claimed.

You can also choose to install the system yourself. Although you can’t claim your own labor as an expense for the credit, you still come out far ahead on overall project costs.

The graph below shows a comparison of the total installed costs (post-Federal Tax Credit) of the same exact system when you choose to DIY, hire locally or source the work to a national installer:

How to File Form 5695 with Your 1040 Individual Tax Return

Once you’ve spent the money, you’ll need to prove it to the government to claim your solar panel tax credit (be sure the person filing is the owner of the system). For that, you need IRS Form 5695 to claim the residential energy credit. If you do need additional tax advice, we recommend consulting with a tax professional.

If you file your own taxes, use the steps below to claim your Residential Renewable Energy Tax Credit.

- Gather all your expense receipts and put them in a safe place.

- Confirm you are eligible for the tax credit. (If you own the system and owe taxes, you’re probably eligible. Check with a tax specialist if you’re not sure.)

- Complete IRS Form 5695 to add up your renewable energy credits (click the link for a step-by-step walkthrough on filing your tax forms).

- Add your renewable energy credit information to your typical form 1040.

That’s it!

We hope this serves as a good introduction to the Federal Solar Tax Credit and helps you navigate the research process. For residents of our home state of CA, we recommend you check out the California solar tax credit page. Everyone else can refer to our database of solar incentives by state for information on how to take advantage of even more solar tax credits.

If you need help from a solar designer, get in touch with us for a consultation. We’re happy to walk you through any questions you may have.