If financing your solar system is your best option, three main financing solutions are available to help alleviate some of the costs, all with their own advantages and some disadvantages.

Why Buy Solar?

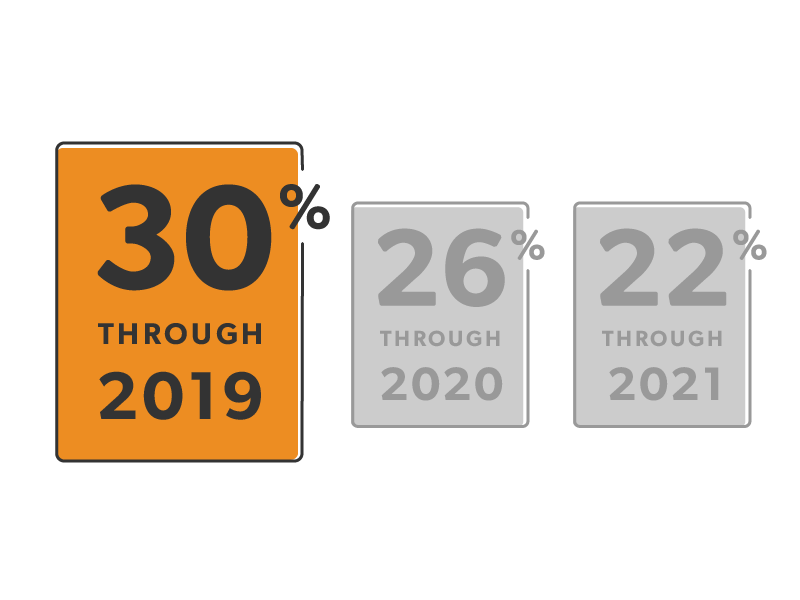

There are many reasons to buy; most importantly, when you buy it, you own it. Of course, solar panel financing can be expensive, so the money you put upfront will be a substantial investment. In most cases, you can claim the interest on your loan to purchase the system as a deduction on your taxes, something you cannot do with the solar lease program.

Systems are very reliable; they hardly ever need maintenance aside from a scheduled inverter replacement a decade or two later. Inverters come with a warranty of 10 years (upgradeable to 20 or 25).

Why Lease Solar?

Solar panel leasing and PPAs (power purchasing agreements) are options if you’re more concerned about offsetting your power bill and using renewable energy sources instead. Solar PPAs vs. leases vary to some degree, but they both allow you to have solar power installed without having to pay for a system. However, you’ll discover that you paid the leasing company more than twice as much as it would have cost you to purchase the system yourself with solar financing.

One of the main advantages of leasing of solar system is that you are not responsible for the maintenance, upkeep, and operation of it. That falls under the responsibility of the lenders, giving you some added peace of mind, especially if your solar system is on a vacation home or summer getaway.

Why Solar Loans?

FHA PowerSaver Loans are available to qualified applicants in many states. These loans help cover the cost of solar panel financing and installation (among other green energy improvements) and come with a reasonable interest rate.

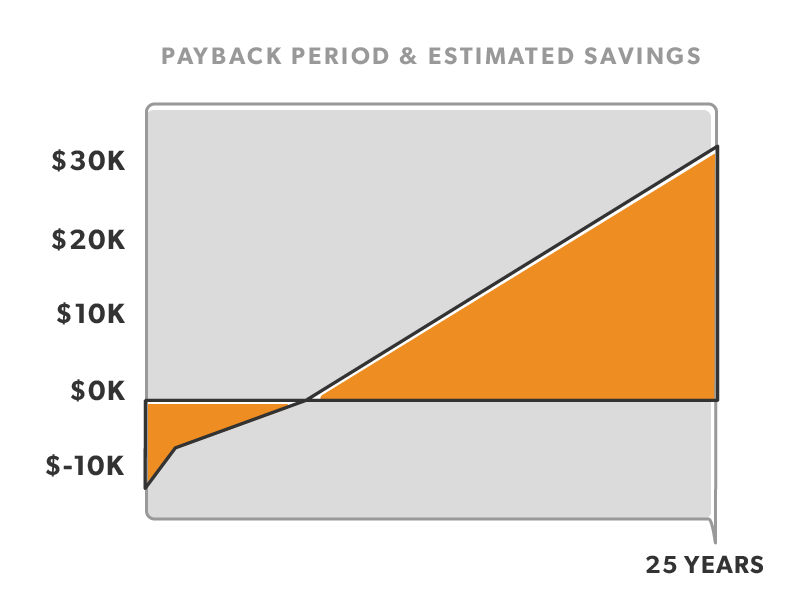

With a loan, you’re paying back both the solar system’s costs and anything you owe on your mortgage, property taxes, etc, making any ROI or utility bill offset negligible until the loan is paid.

Loans can often be paid off in as many as 10 to 20 years, which means you may be paying them off for the entire life of the solar system. By the time your loan is paid off, you may need to replace vital components to keep your solar system functioning.